Weekly Crypto Market Wrap-up:

January 29, 2024

Market Highlights

– SEC Delays BlackRock’s Ethereum ETF Decision: The SEC delays the decision on BlackRock’s spot Ethereum ETF to March.

– Surge in Bitcoin ETFs: Nine spot Bitcoin ETFs acquire 100,000 BTC within 7 days of launch.

– JPMorgan Downgrades Coinbase: Following a disappointing ETF catalyst, JPMorgan downgrades Coinbase stock.

– Global Crypto User Base Reaches 280 Million: The global crypto user base reached 280 million in 2023.

– FTX Sells $1 Billion of Grayscale’s Bitcoin ETF: FTX sells a significant amount due to the exchange’s bankruptcy, resulting in a 22 million share dump.

– Polygon (MATIC) User Growth: Polygon almost acquires as many users as Ethereum in 2023.

– US Economy Growth: The US economy defies recession fears with a 3.3% GDP growth in the last quarter.

– Bank of Japan’s Policy: Bank of Japan maintains an “ultra-loose” policy, aiming for a 2% inflation target.

Technical Analysis: BTCUSD

– Trendline Break and Recovery: BTCUSD experiences a trendline break lower, reaching key support at 38,000 before rebounding above 42,000.

– Spot ETFs and Microstrategy Holdings: 0.68% of circulating BTC supply is in spot ETFs, with Microstrategy’s holdings at 0.89%.

– Future Outlook: Fundamentally and technically strong, anticipating a re-test of 44,000 and potential break of 50,000 in the coming quarter.

Market Insights: Spot Desk

– Balanced Flows: BTC flow remains balanced, with increased interest in altcoins like ICP, SOL, ADA, AVAX.

– Stablecoin Dominance: Rotation from USDT to USDC and USD observed, with stablecoins dominating fiat flows.

Trade Idea: ETH Layer-2 Upgrade

– Protodank Sharding Update: Anticipated to decrease ETH’s layer 2 fees and increase transaction speeds, presenting bullish opportunities for ETH and its layer 2 tokens.

– Relative Value Plays: Consideration of relative value plays with potential impact on Layer 1 competitors.

Derivatives Desk (Wholesale Investors Only)

– Spot/Vol Correlation: Volatility seems unmoved by BTC’s rally, reflecting market sentiment.

– Trade Idea: Consider going short a weekly Iron Condor for the upcoming FOMC meeting, taking advantage of elevated volatility.

Calendar Events to Watch

– Tuesday: US Jolts Job Openings Report.

– Wednesday: FED’s FOMC Conference and Statement.

– Thursday: Bank of England’s Monetary Policy.

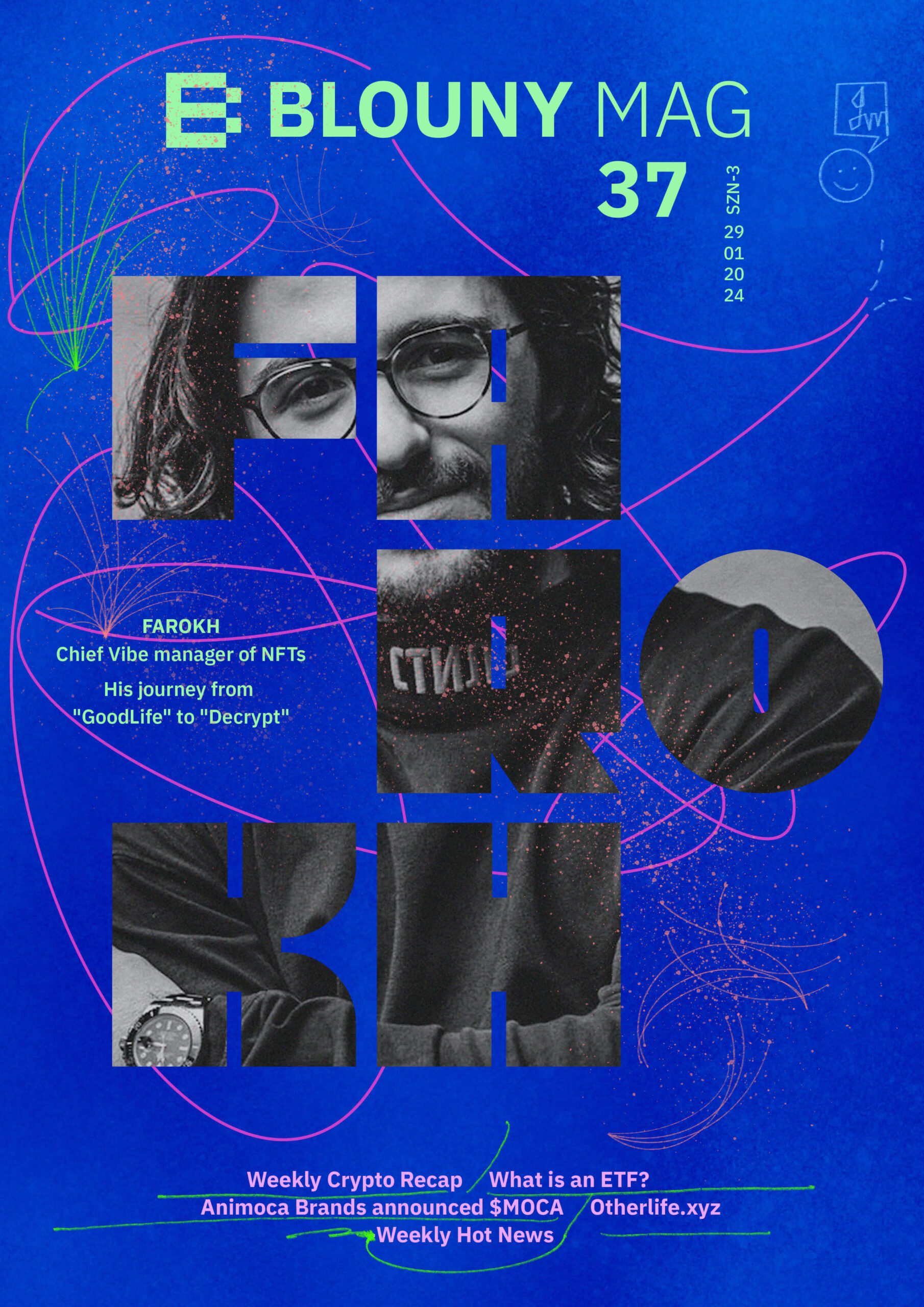

Unveiling Farokh Sarmad: Entrepreneur, Influencer, Visionary

Introduction

Welcome to the world of Farokh Sarmad, a young entrepreneur and social media influencer whose impact reverberates globally. In this exploration, we will delve into Farokh’s net worth, journey, and the extraordinary influence he wields across millions of followers.

Farokh’s Net Worth

Farokh Sarmad, with a background in entrepreneurship and a massive online presence, has amassed a substantial net worth. While the exact figure remains undisclosed, it is estimated to be significant, reflecting his worldwide influence and millions of followers.

Farokh’s Background and Career

Born on September 7, 1994, in Paris, Farokh Sarmad is a Persian entrepreneur based in Montreal, Canada. His rise to prominence began on Instagram, particularly with his page “Thegoodlife,” where he shares motivational content. At the age of 23, he founded his advertising company, showcasing entrepreneurial prowess and visionary leadership.

Focusing on Brand Building

Farokh’s career is marked by transformative collaborations and ventures. Through strategic brand-building initiatives, he has elevated his personal brand, leaving an indelible mark in the industry.

Farokh’s Success and Recognition

Farokh’s success extends to being featured in Forbes, a testament to his significant contributions. His appearances on national TV and podcasts further amplify his influence, solidifying his status as an industry expert.

Farokh’s Personal Life

While Farokh shares glimpses of his daily life on social media, he maintains privacy regarding his relationships. His primary focus lies in expanding his business and inspiring followers through engaging content.

Living the Entrepreneur Influencer Lifestyle

Farokh’s daily routine involves a blend of content creation, networking, and staying abreast of industry trends. His commitment to personal growth plays a vital role in his success.

The Power of Authenticity in Personal Branding

Farokh’s authenticity is central to his personal branding strategy. By sharing experiences and challenges, he resonates with his audience, creating a loyal following.

Farokh’s Reach and Influence

With millions of followers across various platforms, Farokh’s influence spans over 50,000 cities globally. His ability to connect with diverse backgrounds makes him a role model for aspiring entrepreneurs and influencers.

Farokh’s Philanthropic Endeavors

Believing in giving back, Farokh engages in philanthropy to make a positive impact. His actions, though private, reflect a commitment to using influence for the greater good.

Farokh’s Future Projects and Aspirations

Farokh envisions launching an online course for aspiring entrepreneurs, authoring a book, and establishing a nonprofit organization. His dynamic projects aim to empower others and contribute to society.

Conclusion

Farokh Sarmad’s journey as an entrepreneur and influencer exemplifies the transformative power of dedication and authenticity in the digital age. His story inspires millions, showcasing the potential to create meaningful impacts and pursue dreams through social media influence. As Farokh continues to evolve and inspire, his entrepreneurial spirit leaves an indelible mark on the industry.

What is ETF? Exploring the World of Exchange-Traded Funds

Exchange-Traded Fund (ETF)

If you desire the simplicity of stock trading coupled with the diversification benefits of mutual funds, Exchange-Traded Funds (ETFs) may be the answer. Combining the strengths of both assets, ETFs are investment funds offering diversification akin to mutual funds while facilitating stock-like trading.

ETF Meaning

In essence, an ETF is a basket of investments, encompassing stocks or bonds. With the ability to invest in multiple securities simultaneously, ETFs often boast lower fees and increased tradeability compared to other fund types.

When considering ETFs, meticulous evaluation is crucial. Factors such as management costs, commission fees, ease of trading, alignment with your portfolio, and investment quality should all be considered.

Types of ETFs

1. Stock ETFs

– Geared towards long-term growth, these ETFs consist of stocks, providing a balance between risk and return.

2. Commodity ETFs

– Involving raw goods like gold or crude oil, these ETFs require scrutiny for factors such as ownership, futures contracts, and tax implications.

3. Exchange-Traded Notes (ETNs)

– Although not technically ETFs, ETNs are often confused due to similarities. They track assets like commodities or bonds, relying on a formula-tied debt security.

4. Bond ETFs

– Differing from individual bonds, these ETFs generate regular cash payments to investors, making them a lower-risk complement to stock ETFs.

5. International ETFs

– Offering exposure to foreign investments, these ETFs provide a less risky means to diversify a portfolio globally.

6. Bitcoin or Crypto ETFs

– In 2024, the SEC approved spot Bitcoin ETFs, making cryptocurrency more accessible. However, ETFs for other cryptocurrencies remain limited.

7. Sector ETFs

– Divided by industry, these ETFs allow targeted investments in specific sectors, providing exposure to various business cycles.

8. Leveraged ETFs

– Designed to magnify index returns, these ETFs increase both potential gains and risks, making them riskier than other types.

How do ETFs Work?

ETFs involve a fund provider owning underlying assets, creating a fund to mirror their performance, and then selling shares to investors. Despite not owning the assets, investors may receive dividend payments or reinvestments. ETFs trade at market-determined prices, influenced by expenses, leading to variations from underlying asset returns.

ETF Creation and Redemption

Creation and redemption involve an “authorized participant” exchanging assets or cash for ETF shares. This intricate process ensures the ETF’s market value aligns with the value of its underlying assets.

ETF Advantages and Disadvantages

ETF Pros

1. Diversification

– ETFs offer broad diversification horizontally and vertically, safeguarding portfolios against market volatility.

2. Transparency

– Daily disclosure of fund holdings and easy access to price activity enhance transparency, allowing investors to make informed decisions.

3. Tax Benefits

– ETFs generally incur fewer capital gains taxes than mutual funds, providing tax advantages to investors.

ETF Cons

1. Trading Costs

– While many brokers have eliminated ETF commissions, trading costs may still apply, impacting overall expenses.

2. Potential Liquidity Issues

– Less frequently traded ETFs may pose challenges when selling due to market prices.

3. Risk of ETF Closure

– Inadequate assets to cover administrative costs may lead to ETF closures, compelling investors to sell prematurely.

How Much Do ETFs Cost?

ETF costs vary widely, with share prices ranging from single to triple digits. Investors should outline their budget and consider expense ratios, which, for most ETFs, are relatively low.

ETFs vs. Mutual Funds vs. Stocks

Comparing ETFs with other investments underscores their unique advantages, including lower costs, enhanced diversification, and a growing array of options.

ETFs vs. Mutual Funds

ETFs generally feature lower fees and greater tax efficiency than mutual funds. They also differ in management structures, with mutual funds often actively managed and ETFs predominantly passively managed.

ETFs vs. Stocks

While ETFs comprise stocks, there’s no concept of “ETF stock.” ETFs represent a basket of stocks, offering better diversification than individual stocks.

How to Find the Right ETFs for Your Portfolio

Choosing the right ETF involves considering costs, investment style, and the fund’s merits. Investors should beware of gimmicky funds and align their ETF choices with their broader investment objectives.

How to Invest in ETFs

Investing in ETFs is accessible through various channels, from self-directed brokerage accounts to robo-advisors. Opening a brokerage account, selecting suitable ETFs, making the purchase, and holding onto the investment align with individual preferences and investment strategies.

Do ETFs Pay Dividends?

Yes, ETFs pay dividends based on the dividends received from the underlying stocks. Investors receive periodic dividends, typically quarterly, depending on the number of ETF shares held.

Can You Sell an ETF at Any Time?

Absolutely. ETFs, like stocks, can be bought or sold throughout the trading day, providing flexibility to investors to take advantage of intraday price fluctuations.

In conclusion, navigating the world of ETFs requires a comprehensive understanding of their types, advantages, and potential pitfalls. Whether you seek diversified, low-cost investments or want to explore specific sectors, ETFs offer a versatile tool for modern investors.

Animoca Brands Announces $MOCA Token: A Game-Changer in Web3

Moca Foundation Announces $MOCA Token Coming Soon

The Moca Foundation is set to make waves in the blockchain and NFT space with the announcement of the upcoming $MOCA token, according to Foresight News. While specific details about the token remain under wraps for now, the foundation hints at an imminent revelation.

Mocaverse, Animoca Brands Strategic Launch Partners for $MOCA

In a significant strategic move, Mocaverse, a subsidiary of Animoca Brands, has officially partnered with the Moca Foundation for the launch of the revolutionary $MOCA token. This partnership not only lends support to the token but also aims to drive its adoption in the Mocaverse, Animoca Brands ecosystem, and beyond. The collaboration intends to expand the reach of the $MOCA token across various platforms and industries.

The Deets

– Strategic Partnerships: Animoca Brands and Mocaverse NFT strategic launch partners

– Token Launch: Introduction of the $MOCA token

– Key Focus: Enhancing network growth, cultural integration, and shared governance

– DAO of DAOs: Central governance token powering Moca DAO

Animoca Brands and Mocaverse NFT Join Forces as Strategic Partners

Animoca Brands, a global leader in blockchain gaming and NFTs, along with its flagship NFT project, Mocaverse, has emerged as a strategic launch partner for the Moca Foundation and the much-anticipated $MOCA token.

The Bulk

The $MOCA token, positioned as the growth engine of web3, aims to onboard key cultural pillars like gaming, sports, and intellectual property into its ecosystem. Serving as the central governance token, $MOCA is set to power the Moca DAO, establishing itself as the DAO of DAOs.

The strategy of the Moca Foundation revolves around creating synergies across on-chain cultural economies. Leveraging strategic partnerships with Animoca Brands and Mocaverse NFT, the foundation seeks to fuel growth and connect diverse communities within its ecosystem.

The launch of $MOCA is poised to contribute to the development of both the Moca Foundation and Animoca Brands ecosystems. As details about the token and its potential applications unfold in the coming days, the collaboration promises innovation and advancement in the web3 space.

$MOCA Token – A Unique Offering in Web3

The Moca Foundation’s tweet, “One coin to unite all cultures $MOCA,” set the stage for the unveiling of $MOCA. Described as more than just a token, it aims to break barriers, fuel network growth, unite cultures, and foster cross-community synergy through shared governance.

What’s on the Menu?

– Network Growth Redefined: $MOCA by Moca Foundation is hailed as the growth network token redefining the network effect in Web3.

– Cultural Pillars Onboarded: It aims to onboard key cultural pillars, including gaming, sports, and intellectual property, into Web3.

– Central Governance: $MOCA, as the central governance token, powers the Moca DAO, positioned as the DAO of DAOs.

In a tweet by the Mocaverse, the NFT project revealed its role as an inaugural launch partner of the Moca Foundation. Both the project and the broader Animoca Brands ecosystem are set to adopt $MOCA across their ecosystems.

With the Moca Foundation’s strategic approach and the backing of powerful partnerships, the $MOCA token’s launch later this year is anticipated to make a significant impact in the on-chain cultural economies. Stay tuned for updates and details on this groundbreaking token launch.

For more information, visit [Moca Foundation]

Otherlife.xyz: Revolutionizing Web3 Creativity with MoonPay

Unveiling Otherlife.xyz

A Digital Creative Hub in Toronto

Otherlife.xyz, a Toronto-based multidisciplinary digital creative studio, merges creativity, technology, and craft to design immersive digital experiences. Acquired by MoonPay in 2023, it’s now a key player in reshaping the web3 creative landscape.

MoonPay’s Strategic Move

Transformative Acquisition

MoonPay’s acquisition of Otherlife.xyz in January 2023 marked a strategic shift. The collaboration aims to offer end-to-end support for brands venturing into crypto, collectibles, and the metaverse, facilitating complete web3 strategy execution.

Diverse Creative Offerings

Services and Innovations

Otherlife.xyz provides a range of services, from branding to NFT design. Innovative projects like “The Wella Generator” showcase their capabilities in gamified sweepstakes experiences with web3 integration.

Meet the Minds Behind Otherlife.xyz

Dynamic Leadership

Led by Michael Perrow (CEO) and Michael Moodie (CCO), the leadership brings rich industry experience, guiding Otherlife.xyz toward becoming a major web3 creative hub.

MoonPay’s Influence on Web3

Revolutionizing Transactions

MoonPay, a payments infrastructure company, acts as a bridge between traditional fiat currencies and digital currencies. Strategic initiatives, including NFT distributions to celebrities, have popularized NFTs and Web3.

MoonPay and Otherlife.xyz: Shaping the Future

Beyond Transactions: Creating Experiences

While MoonPay focuses on transactions, Otherlife.xyz dives deeper into web3, creating immersive experiences and revolutionizing brand interactions. This collaboration is set to leave a lasting mark on the future of digital creativity.

Stay tuned for more innovation and creativity in the unfolding chapters of the MoonPay and Otherlife.xyz collaboration. Follow [Otherlife.xyz] and [MoonPay] for updates.

Weekly Hot News:

Magic Eden Unleashes Trio of Cross-Chain NFT Initiatives

Own a Piece of Banksy’s Original ‘Turf War’ Artwork via NFTs

Gas Hero Attracts 10K Players, $90M NFT Trades in 1 Month

Axie Infinity Opens ‘Homeland Beta’ – A Land of New Opportunities

Rari Chain Mainnet Launch Spotlights 10 Distinct NFT Drops

Phantom Announce Surprise $WEN Launch, Airdrop Now Live

Magic Eden pave way for new token called NFT

Quantum Cat sells for $250k in Sotheby’s auction

3AC NFTs head to Sotheby’s auction again

Microsoft & Nvidia hit new ATHs

Mocaverse hits 5ETH after MOCA token reveal

Pudgy Penguins sold 750k toys worldwide

No comment